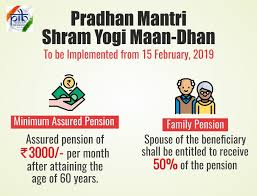

Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM)

The PM-SYM is a 50:50 voluntary and contributory pension scheme in which the beneficiary makes a stipulated age-specific contribution and the Central Government matches it.

For example, if a person joins the system at the age of 29, he must give Rs 100 per month until he reaches the age of 60, at which point the Central Government would contribute an equal amount of Rs 100. The subscriber will get the assured monthly pension of Rs 3000/- with benefit of family pension, as the case may be.

Eligibility under the scheme

The beneficiary of the scheme can be any worker of the unorganised sector mostly engaged as home-based workers, street vendors, mid-day meal workers, head loaders, brick kiln workers, cobblers, rag pickers, domestic workers, washer men, rickshaw pullers, landless labourers, own account workers, agricultural workers, construction workers, beedi workers, handloom workers, leather workers, audio- visual workers and similar other occupations.

According to the Labour Ministry, any worker whose monthly income is Rs 15,000/per month or less and belong to the entry age group of 18-40 years are eligible for the scheme.

Moreover, they should not be covered under New Pension Scheme (NPS), Employees’ State Insurance Corporation (ESIC) scheme or Employees’ Provident Fund Organisation (EPFO). Further, he/she should not be an income tax payer.